Lei Jun’s Capital Dilemma: How much imagination does Xiaomi’s ecological chain have?

Shanghai securities news, a well-known domestic securities media, once described Xiaomi eco-chain enterprises in "Xiaomi Department": Real Bottleneck and Fantasy Valuation ":

1) Eco-chain enterprises are more like the OEM departments of Xiaomi’s product lines than independent operations;

2) Although the relevant founder is the largest shareholder, the actual control right behind the complicated shareholding structure still belongs to Lei Jun;

3) The high related party transactions make Xiaomi Eco-chain Company and Xiaomi more like a "family".

Since it is a "family", it is common to leverage each other for common development; But once the dependence is formed, it greatly increases the difficulty of capitalization.

As the largest ecological chain group in China, Lei Jun and many enterprises in its Xiaomi ecological chain once dreamed of going to the distant capital market. Now, they have to face the cold reality because the regulators are not stupid.

More than 20 days ago, the proposal of all-magic acoustic backdoor under Xiaomi Ecological Chain was rejected by CSRC, and the right and wrong of Xiaomi Ecological Chain and the ultimate trend of Xiaomi Empire were once again put before the public.

There are two main audit opinions of the M&A Committee of CSRC:

1) The company’s disclosure that the actual controller of Wanmo Acoustics has not changed in recent three years is not sufficient;

2) The sales and profit sources of Wanmo Acoustics are highly dependent on related parties.

If you don’t quite understand the meaning of these two sentences, then compare them with the three descriptions of shanghai securities news above.

In fact, this seemingly dull veto has dealt a fatal blow to Lei Jun and Xiaomi’s eco-chain, and also intuitively demonstrated many business dilemmas of eco-chain enterprises pointed out by the Shanghai Stock Exchange in its report:

Single product structure, serious related party transactions, lack of independent pricing power, excessive dependence of brands and channels on Xiaomi, and doubts about the stability of ownership structure …

The Shanghai Stock Exchange pointed out that "from the business, it is increasingly difficult for eco-chain enterprises and Xiaomi to be independent of each other; From the perspective of capital market rules, eco-chain enterprises may not be listed separately. " If Xiaomi is listed on the A-share market, it will face the problem of related party transactions, and the listing of eco-chain enterprises will face the question of independence.

Serious financial contact interviewed relevant people of Xiaomi Group, and no reply was received as of press time.

01

The backdoor is denied, whose magic acoustics?

The first reason why the CSRC vetoed the backdoor of Wanmo Acoustics is:The company’s disclosure that the actual controller of Wanmo Acoustics has not changed in the past three years is not sufficient.

Translate this sentence as follows:Tell me honestly, who is the boss of Wanmo Acoustics?

In fact, the matter itself is not complicated.

According to the equity change report disclosed by electroacoustic, Wanmo Acoustics was established in October 2013. In December 2016, Xiaomi began to invest in Wanmo Acoustics, mainly producing Xiaomi piston headphones for Xiaomi OEM.

Up to now, Gary Hsieh holds 20.9408% equity of Wanmo Acoustics by adding Hong Kong, HKmore, Wanmo Guanxing, Wanmo Yingren, Wanmo Renju, Wanmo Shuntian and Wanmo Hengqing, and is the actual controller of Wanmo Acoustics on paper.

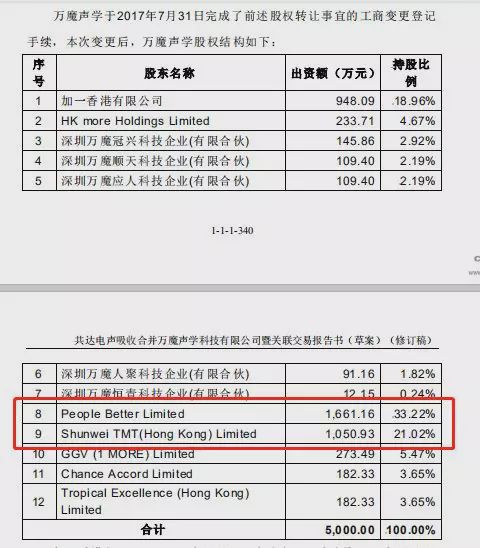

According to the inquiry announcement, in the historical shareholding change of Wanmo Acoustics, People Better Limited once became the largest shareholder of the company, with a shareholding ratio of 33.32% and a majority of the board seats. The CSRC asked it to supplement whether the actual controller of the company has changed.

In this regard, Wanmo Acoustics replied that the change in shareholding ratio is only the adjustment of the red-chip structure, and the financial investors do not participate in the actual operation, and the actual controller has always been Gary Hsieh. However, supervision is still in doubt.

Why do regulators cling to this issue?

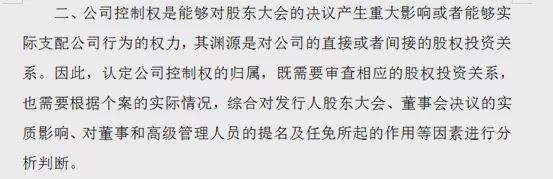

According to the understanding and application of Article 12 of the Measures for the Administration of Initial Public Offering and Listing of Stocks —— Opinions on the Application of Securities and Futures Law No.1 (Zheng Jian Zi [2007] No.15, hereinafter referred to as Opinions on the Application of Securities and Futures Law No.1), the CSRC defines the company’s control right as:

(Source: Official Document of CSRC)

Generally speaking, the identification of the actual controller is based on the principle of "substance is more important than form" and combined with the specific analysis of individual cases.

There are two unavoidable problems:

1) Is the big boss of the company Xiaomi or Gary Hsieh? This is related to the change of ownership structure.

2) Who has the final say in the actual operation of Wanmo? Is it the millet that hatched it, or Gary Hsieh?

According to the description of the absorbed party in the electro-acoustic absorption scheme, People Better Limited was once the largest shareholder of Wanmo Acoustics and held a majority of seats. According to public information,People Better Limited is a subsidiary of Xiaomi Technology Co., Ltd., and the actual controller of Xiaomi Technology is Lei Jun.

(Source: A total of electroacoustic history announcements)

Shunwei, another shareholder of Wanmo Acoustics, Xu Dalai is the actual controller and the former non-executive director of Xiaomi Technology, but as we all know, Lei Jun is the big boss of Shunwei Capital.

(Source: Historical Announcement)

Back to July 31st, 2017, Xiaomi’s People Better Limited and Shunwei TMT(HongKong) Limited invested 16,611,600 yuan and 10,509,300 yuan respectively, holding 33.22% and 21.02% of the shares, with a total holding of 54.24%, and the proper largest shareholder plus the actual controller.

(Source: A total of electroacoustic history announcements)

After several rounds of capital increase and equity transfer,Up to now, the shareholding ratios of People Better Limited and Shunwei TMT(HongKong) Limited are 11.15% and 7.19% respectively, making a total of 18.34%, second only to Gary Hsieh’s 20.9408%.

What is the inner feeling behind the arrangement and change of this ownership structure? Is there a proxy? As a result, Gary Hsieh is only the nominal actual controller? After the evaluation benchmark date announced in the draft merger plan, People Better Limited and Shunwei TMT(HongKong) Limited continued to reduce their shareholding ratio. What is the purpose?

The answers to these questions are the core of the regulatory authorities’ continuous questioning of the actual controller of Wanmo Acoustics.

02

Business dependence and related party transactions rely on Xiaomi to make money?

Regarding the second question that the CSRC is concerned about:The sales and profit sources of Wanmo Acoustics are highly dependent on related parties.This problem is also unavoidable for any party.

Backed by Xiaomi’s powerful channels and traffic, the compound growth rate of Wanmo Acoustics revenue in the past three years is as high as 47%.

However, this performance growth has also caused Wanmo Acoustics to rely on Xiaomi’s performance.

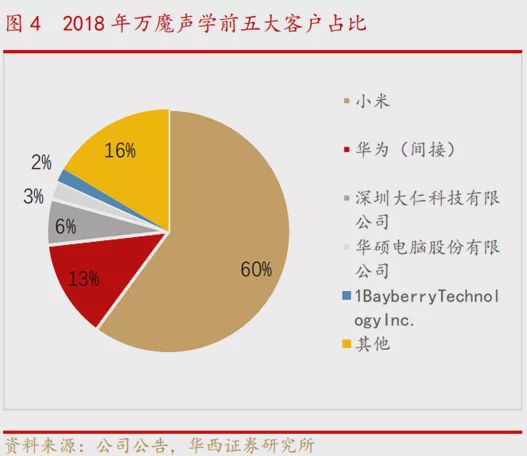

During the reporting period, the sales proportion of the top five customers of Wanmo Acoustics in 2016 -2018 was 86.01%, 83.17% and 83.54% respectively. Among them, Xiaomi Group is a related party and the company’s largest customer, with sales accounting for 59.45%, 64.24% and 60.12% respectively.

You can understand that if there is no Xiaomi, the performance of Wanmo Acoustics will collapse by at least half.

Moreover, such high correlation and dependence also lead to the lack of autonomy in sales channels and product pricing of Wanmo Acoustics:

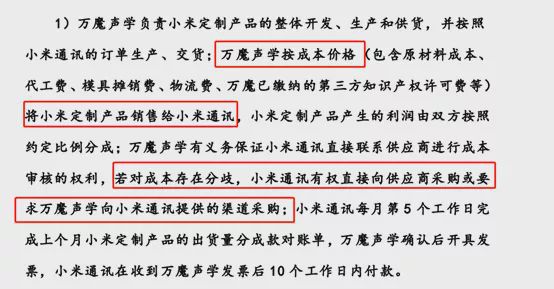

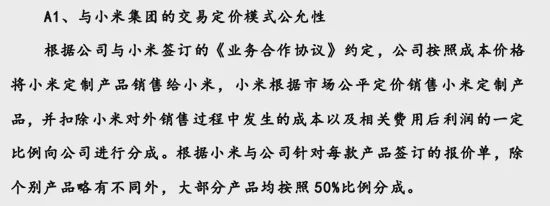

- Wanmo Acoustics sells Xiaomi ODM products to Xiaomi Communication according to the cost price, but the cost audit is checked by Xiaomi Communication;

- Wanmo Acoustics does not have the independent right to set the retail price of Xiaomi ODM products. The products are sold by Xiaomi according to the fair market price, and the profit is divided into 50%.

It is this dependence and lack of relative autonomy in the main business that determines profits that makes Wanmo’s profitability lower than that of similar companies.

According to the report of Securities Market Weekly, the historical data of Wanmo Acoustics shows that,The gross profit margin of ODM headphones is 23.89% to 27.56%, while that of OBM (private brand) headphones is 33.59% to 38.14%.

In the case that ODM accounts for more than half of the revenue (57.65% in the first half of 2019), most of the surplus value of Wanmo acoustic products is "deprived" by downstream customers, namely Xiaomi.

Business dependence, related party transactions, combined with the CSRC’s questioning of the actual controller of Wanmo Acoustics, it is not difficult for us to understand the real intention of the regulatory authorities to be so cautious.

Behind this is actually a cliche:Why do regulators attach so much importance to related party transactions?

Due to the sales and purchases with related parties, there may be accommodation or even fraud in terms of price, payment method and account period. A large proportion of related party transactions will distort the company’s financial data, which is not conducive to investors’ accurate judgment. At the same time, there are risks such as interest transfer, which is likely to damage the interests of listed companies and thus the interests of investors.

In order to protect the interests of investors, especially small and medium-sized investors, the regulatory authorities are particularly strict in the disclosure management of related party transactions.

However, as an independent enterprise, Wanmo Acoustics is not convincing enough in its sustainable management ability and independence.

03

Capitalization is difficult. Is the label "Xiaomi" an assist or an obstacle?

The problem of magic acoustics is also common in Xiaomi ecological chain enterprises:

1) The adjustment of ownership structure has experienced the changes in equity process from Xiaomi Holdings to Xiaomi’s shareholding;

2) In terms of business structure, Xiaomi is both a related party and the largest customer.

According to the report of Shanghai Stock Exchange, Huami Technology also has the same subtle equity arrangement as Wanmo Acoustics. According to its prospectus, the company’s largest single shareholder is Huami CEO Huang Wang, holding 39.4% of the shares; Shunwei Capital holds 20.4%, and Xiaomi’s fund People Better limited holds 19.3%. Shunwei Capital and Xiaomi are controlled by Lei Jun.. Therefore, although Huang Wang is the largest natural person shareholder, Lei Jun’s consolidated shareholding ratio is 39.7%, which has surpassed Huang Wang.

In addition, judging from the disclosed prospectus, the performance of Huami also reflects that Xiaomi is highly dependent on the eco-chain company: in the first three quarters of 2015, 2016 and 2017, the revenue contributed by mi band to Huami Technology was 870 million yuan, 1.434 billion yuan and 1.068 billion yuan respectively, accounting for 97.1%, 92.1% and 82.4% of Huami Technology’s revenue in the same period.

Coincidentally, Roborock, another typical enterprise of Xiaomi Eco-chain, also experienced repeated inquiries and verification by the regulatory authorities before listing in science and technology innovation board.

According to the prospectus, Roborock’s gross profit margin in recent three years was 19.21%, 21.64% and 28.79% respectively, while Cobos’s gross profit margin remained at around 36%. In terms of splitting, the gross profit margin of its own brand products is 42.06% higher than that of Cobos, but the gross profit margin of "Mijia Robot" produced for Xiaomi is 14.99%, which lowers the average gross profit of the company.

In addition, there are ten business risks related to Xiaomi’s cooperation mode in the prospectus, involving a large number of related transactions, ODM business dependence, foundry selection and so on.

It can be seen that the two fatal problems of the rejection of Wanmo Acoustics also exist in Roborock and Huami Science and Technology.

Looking back on the development of Xiaomi’s ecological chain, Xiaomi and the ecological chain company have achieved mutual success.

Starting from Xiaomi itself, the products of these eco-chain enterprises support the high efficiency of Xiaomi’s offline channels and greatly share the operating costs of offline stores; As for the "world’s largest intelligent hardware IOT platform" planned by Lei Jun for Xiaomi, the mobile phone is only one of the terminals, and the "data" and "control" of products of a number of eco-chain enterprises are also the core of the platform.

To this end, Xiaomi’s approach is:Investing in eco-chain companies, splitting the product departments that should exist into eco-chain companies, and finally making Xiaomi’s shareholding equal to that of the founders of eco-chain companies through ingenious equity design, thus achieving the status quo of controlling these eco-chain companies and seemingly "independent".

According to this capital path, "eco-chain enterprises" will be listed independently, and Xiaomi will convert the business income of its multi-product lines into investment income. At the same time, there will be a number of listed companies in the whole system of Xiaomi, which will open up new space for the capital operation of Xiaomi.

This is the capital imagination of Xiaomi and its ecological chain.

But in the process of capitalization, the disadvantages of ecological chain are gradually emerging:

- Eco-chain enterprises are more like the OEM departments of Xiaomi’s product lines. They have no independent pricing power and product autonomy. Their own brand channels and capital are weaker than the OEM model, and their independent operation is doubtful.

- In terms of shareholding structure, although the relevant founder is the largest shareholder. However, tracing back to the actual control right behind the complex ownership structure, there are Lei Jun or Xiaomi, and problems such as A-shares and related party transactions cannot be avoided.

From this perspective, the independent development of eco-chain enterprises may be a good wish from the beginning.

THE END

This article is written bySerious finance and economicsOriginal production, please do not reprint without permission.

Wen | Fu Jie♀