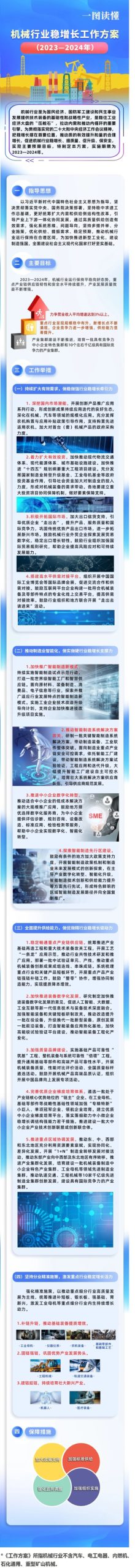

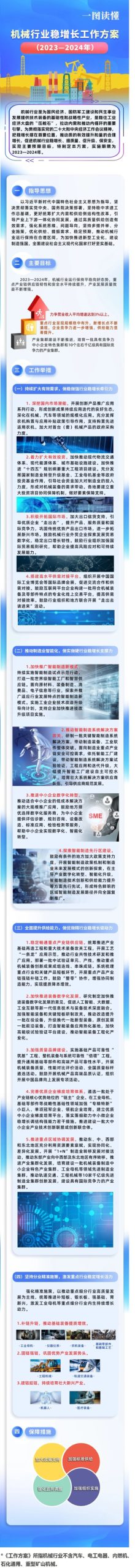

In order to promote the steady growth of the machinery industry, improve quality, promote upgrading and ensure safety, seven departments, including the Ministry of Industry and Information Technology, the Ministry of Finance, the Ministry of Agriculture and Rural Affairs, the Ministry of Commerce, the General Administration of Customs, the General Administration of Financial Supervision and National Medical Products Administration, recently jointly issued the Work Plan for Steady Growth of the Machinery Industry (2023-2024), proposing that the operation of the machinery industry will maintain a stable and positive trend in 2023-2024, and the supply chain of key industrial chains will be resilient and resilient. The specific objectives are: strive to achieve an average growth rate of operating income of more than 3% and reach 8.1 trillion yuan by 2024; The scale of key industries is rising steadily, new growth points are constantly emerging, the competitiveness of enterprises is further enhanced, and the supply capacity is significantly improved; The construction of industrial clusters has been continuously promoted, and a number of competitive small and medium-sized enterprise characteristic clusters and about 10 industrial clusters with international competitiveness have been cultivated.

Notice on Printing and Distributing the Work Plan for Steady Growth of Machinery Industry (2023-2024)

Ministry of Industry and Information Technology Unicom Zhuang [2023] No.144

Departments in charge of industry and information technology, finance, agriculture and rural areas, commerce and drug administration of all provinces, autonomous regions, municipalities directly under the Central Government, cities specifically designated in the state plan, Xinjiang Production and Construction Corps, Guangdong Branch of the General Administration of Customs, customs directly under the Central Government, and supervision bureaus of the General Administration of Financial Supervision:

The Work Plan for Steady Growth of Machinery Industry (2023-2024) is hereby printed and distributed to you, please conscientiously implement it in light of the actual situation.

Ministry of Industry and Information Technology

the Ministry of Finance

Ministry of Agriculture and Rural Affairs

Ministry of Commerce

General Administration of Customs

General administration of financial supervision

National Medical Products Administration

August 17, 2023

Work plan for steady growth of machinery industry (2023-2024)

Machinery industry is a basic and strategic industry that provides technical equipment for national economic development, national defense and military construction and people’s livelihood. It is a "ballast stone" to stabilize the industrial economy, an important engine to stimulate domestic demand and promote internal circulation. At present, the international situation is complicated and changeable, and the "triple pressure" of domestic economic development still exists. The development of China’s machinery industry is facing a new situation, and the pressure of steady growth of the industry is greater. To implement the spirit of the 20th National Congress of the Communist Party of China and the spirit of the Central Economic Work Conference, give priority to steady growth, promote effective improvement of quality and reasonable growth of quantity, promote steady growth of machinery industry, improve quality, promote upgrading, ensure safety, and achieve the main expected goals, this plan is specially formulated, and the implementation period is 2023-2024.

I. Guiding ideology

Adhere to the guidance of Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, resolutely implement the decision-making arrangements of the CPC Central Committee and the State Council, adhere to the general tone of striving for progress while maintaining stability, better coordinate the structural reform of the supply side and expand domestic demand, guide the integrated and coordinated development of the upstream and downstream industries, create effective demand through high-quality supply, strengthen systematic thinking and problem orientation, adhere to multi-measures and separate policies, optimize supply, boost demand and stabilize expectations, and promote the operation of the machinery industry to remain in a reasonable range in order to accelerate the promotion of new types.

Second, the main objectives

From 2023 to 2024, the operation of the machinery industry maintained a steady and good trend, the resilience and safety level of the supply chain of key industrial chains continued to improve, and the quality and efficiency of industrial development continued to increase. The specific objectives are: strive to achieve an average growth rate of operating income of more than 3% and reach 8.1 trillion yuan by 2024; The scale of key industries is rising steadily, new growth points are constantly emerging, the competitiveness of enterprises is further enhanced, and the supply capacity is significantly improved; The construction of industrial clusters has been continuously promoted, and a number of competitive small and medium-sized enterprise characteristic clusters and about 10 industrial clusters with international competitiveness have been cultivated.

Third, work initiatives

(A) continue to expand effective demand, do a steady and strong industry steady growth traction.

Implement the strategy of expanding domestic demand, take the promotion of effective demand as the guide, focus on expanding investment, promoting consumption, stabilizing exports, fully stimulate the demand potential, and make it a strong engine for the sustained growth of the industry.

1. Dig deep into the domestic market potential. We will carry out a series of actions to promote and apply innovative products such as industrial mother machines, instruments and meters, agricultural machinery and equipment, high-end medical equipment, intelligent detection equipment and robots, and create a number of application verification units, production lines or typical scenarios to form a good ecology for continuous application and iteration of innovative achievements. Give full play to the guiding role of agricultural machinery purchase and application subsidy policy, and support the purchase of advanced and applicable agricultural machinery. Promote the construction of a "one big and one small" agricultural machinery and equipment research and development, manufacturing, promotion and application pilot area. Carry out an integrated pilot project of agricultural machinery R&D, manufacturing, promotion and application. Compile the application promotion catalogue of industrial mother machine, high-end instruments and intelligent detection equipment, and deepen the large-scale application in machinery, automobile, aerospace, electronics and other fields. Give play to the traction role of the central financial funds, and support the daily procurement of science and technology, education and medical institutions and give priority to the procurement of high-end innovative instruments and meters in major project construction. Increase the government procurement of the first (set) mechanical products.

2. Focus on expanding effective investment. We will accelerate the development of modern logistics and transportation systems such as strategic backbone channels, high-speed railways, general-speed railways, expressways, port and shipping facilities, modern airports and logistics hubs, as well as modern energy systems such as clean energy bases, power delivery channels and coastal nuclear power, and urban infrastructure such as smart parking facilities and new energy vehicle charging and replacing facilities, and continue to promote the development of intelligent equipment such as construction machinery, rail transit equipment, instrumentation and civil machinery. Accelerate the construction of major projects in the "Tenth Five-Year Plan" such as intelligent manufacturing and robotics, major technical equipment, new energy vehicles and intelligent networked vehicles, agricultural machinery and equipment, high-end medical equipment and innovative drugs, and continuously expand the demand for industrial mother machines, instruments and meters, pharmaceutical equipment and industrial robots. Give full play to the role of government investment funds such as the National Manufacturing Industry Transformation and Upgrading Fund, the Industrial Machine Tool Fund and the Small and Medium-sized Enterprise Development Fund, and guide social funds to increase investment in the manufacturing industry, so as to form a physical workload as soon as possible and form a demand for machinery and equipment. All localities should establish a collaborative guarantee mechanism for major investment projects, and coordinate the support of factors for the land and energy demand of projects included in the list of major projects.

3. Actively explore the international market. Increase export credit insurance and credit support, guide high-quality enterprises in agricultural machinery and equipment, basic parts and other industries to "go global", improve the quality of products and services and international competitiveness, and consolidate the export market of traditional superior products. Encourage enterprises to make good use of free trade agreements such as the Regional Comprehensive Economic Partnership Agreement, actively participate in building the "Belt and Road", give full play to the role of platforms such as comprehensive insurance zones and industrial regional exhibitions, optimize the structure of export products, and further expand emerging markets. Support construction machinery, rail transit equipment and other enterprises to carry out global operations, actively participate in the revision of international standards, promote the overseas recognition and application of China standards, and improve the global brand service system. Track and study the technical trade measures of relevant countries, actively help enterprises to bail out, cross and break foreign technical trade barriers and promote the export of machinery and equipment. Encourage foreign trade enterprises in the machinery industry to explore and develop trade digitalization and stabilize export growth resilience. Encourage all localities to actively use existing capital channels to support small and medium-sized enterprises to participate in overseas exhibitions and expand overseas orders. Encourage industry organizations to strengthen the study of international trade rules and trade situation, help enterprises improve their risk response capabilities, and enhance their overseas business compliance, safety and sustainable development capabilities.

4. Build a high-level supply and demand docking platform. Organize international brand exhibitions such as China International Industry Fair, World Intelligent Manufacturing Congress and World Robotics Congress, support industry organizations to hold exhibition forums in sub-sectors such as machine tools, instruments and construction machinery, promote technical exchanges, international cooperation, and connect upstream and downstream of industrial chains to stimulate market demand. Run China International Import Expo, China Import and Export Commodities Fair, China International Consumer Goods Expo and other major international exhibitions, promote the docking of supply and demand, support industry organizations to hold docking exchange activities such as information exchange meetings and technological achievements fairs on a regular basis, and help enterprises to obtain effective market information in time and promote innovative achievements. Encourage Internet platform enterprises to build a number of professional online trading platforms that meet the characteristics of mechanical equipment and spare parts, and form a one-stop supply-demand docking mechanism for online exhibitions, exchanges and docking, business negotiations, logistics and transportation, and after-sales service to improve the efficiency of supply-demand docking. Encourage industry organizations and local governments to jointly carry out "going out and inviting in" activities, and encourage local governments to provide policy funds and other support for hosting international exhibitions and forums and going abroad to participate in and watch exhibitions.

(2) Promote the intelligentization of manufacturing industry and do solid support for the steady growth of hard industries.

Adhere to the main direction of intelligent manufacturing, take the promotion of intelligent transformation and upgrading of manufacturing industry as the main line, take the application and promotion of new models and the construction of pioneering areas as the guide, drive key technological breakthroughs and model innovation, fully release the demand for upgrading and upgrading of manufacturing equipment, and make it a base for the steady growth of the hard machinery industry.

1. Accelerate the promotion of new intelligent manufacturing models. We will continue to implement pilot demonstration actions of smart manufacturing, build a number of world-class smart factories and smart supply chains, and explore changes in enterprise forms and industrial models. Facing the raw material industry, we will break through advanced process control and energy consumption emission optimization to achieve efficient, safe and green production. Facing the equipment manufacturing industry, carry out model-driven research and development, digital virtual pilot test, etc., and build agile and efficient high-end equipment research and development capabilities. Facing the consumer goods industry, we will explore direct manufacturing and distributed manufacturing for users to meet diversified and high-quality consumer demand. Facing the electronic information industry, we will implement early warning and intelligent control of supply chain risks and build a resilient and flexible supply system. Implement the guidance plan for technological transformation and upgrading of industrial enterprises and support enterprises to accelerate the implementation of technological transformation and upgrading projects.

2. Promote the research of intelligent manufacturing system solutions. Develop a number of key intelligent manufacturing system solutions to drive the overall breakthrough of manufacturing equipment and industrial software. Relying on major projects and key enterprises, focusing on the common needs of key industries such as typical scenes and key processes, we will tackle key problems with a number of complete sets of intelligent manufacturing equipment, develop a number of industry-specific software, create a number of standardized, easy-to-popularize and independent intelligent manufacturing system solutions, promote collaborative innovation of intelligent manufacturing equipment, software and solutions, and support intelligent factory construction and operation, production process optimization, product life cycle management and supply chain collaboration. Facing the safety and controllable demand of key industrial chains in manufacturing industry, relying on the construction of smart factories, it will drive the experimental verification, engineering application and iterative upgrade of intelligent manufacturing system solutions, and greatly improve the self-controllable level of smart factory construction. Cultivate and expand the team of system solution suppliers, improve the classification system of system solution suppliers, further standardize the content, process and quality requirements of integrated services, and guide the standardized development of suppliers.

3. Promote the digital transformation of SMEs. Give play to the leading role of technological transformation, and promote the large-scale popularization and application of low-cost solutions suitable for small and medium-sized enterprises for typical scenarios such as lean management, online inspection, intelligent warehousing and quality traceability. Give play to the leading role of leading enterprises in the supply chain, promote upstream and downstream enterprises to popularize intelligent manufacturing equipment and software, advanced management concepts and key manufacturing processes, and comprehensively improve the digitalization and intelligence level of key industries. Encourage local governments to select digital service providers, provide assessment and diagnosis, planning consultation, equipment renovation, standard application, inspection and testing services for small and medium-sized enterprises, and help them realize digital and intelligent transformation.

4. Explore the construction of intelligent manufacturing pioneer areas. Encourage qualified places to increase policy support, carry out innovative exploration of intelligent manufacturing policy mechanism and future development model of manufacturing industry, and try first in leading industries’ digital transformation, intelligent upgrading, intelligent manufacturing technology innovation and supply capacity improvement, so as to form a distinctive regional intelligent manufacturing development path and replicate it to the whole country. Support areas with strong foundation and complete elements, comprehensively enhance the innovation, application, supply and support capabilities of intelligent manufacturing, and create a comprehensive development benchmark with significant leading effect. Support areas with distinctive characteristics of leading industries, carry out in-depth construction of smart factories and smart supply chains, and form a popular model with outstanding manufacturing capabilities. Support areas where equipment, software, system solutions and other supply resources gather, promote the cultivation of high-quality suppliers, and build an industrial base with strong independent supply capacity. Support areas with outstanding innovation resource endowments and advantages, promote technological innovation research, and create innovation-driven models.

(C) comprehensively enhance the supply capacity, and be the driving force for the steady growth of the excellent and refined industries.

Insist on deepening the structural reform of the supply side, take the overall improvement of supply capacity as the main line, strengthen the construction of industrial ecological system, improve the resilience of industrial chain supply chain, lead and create effective demand with high-quality supply, and promote a virtuous circle of supply and demand at a higher level.

1. Stabilize and smooth the supply chain of key industrial chains. Coordinate the promotion of industrial base reconstruction projects and major technical equipment research projects, and carry out "one-stop" application demonstration of technology. Accelerate the construction of national manufacturing innovation centers such as advanced rail transit equipment, robots, high-performance medical equipment and agricultural machinery equipment, and lay out and build a number of industrial basic common technology centers such as industrial mother machines, instruments and meters to promote the research and development, popularization and application of industry common technologies. Deploy a number of pilot verification units and production lines to promote the innovative achievements of key machinery and equipment to be connected in groups and beaded into chains. Systematically sort out the short-board links of key industries and key products, and carry out the work of strengthening the chain of key product industry chains. Encourage the "zero" cooperation, guide the whole machine enterprises and basic parts enterprises to build a new cooperation mechanism of co-creation, path exploration, risk sharing and benefit sharing, realize the combination of technology research and development and manufacturing process improvement in parts research and development, test and testing, enhance collaborative manufacturing capabilities, jointly promote product industrialization, and achieve quality improvement, cost reduction and efficiency improvement.

2. Accelerate the development of digital equipment. Study and formulate opinions on accelerating the development of equipment digitalization, promote the deep integration of new generation information technology and equipment technology such as artificial intelligence, big data and industrial interconnection, and improve the level of equipment digitalization and intelligence. We will build a high-efficiency innovation system, promote the construction of innovation centers such as industrial control and intelligent detection, and the national industrial metrology and testing center, strengthen the research and development of intelligent equipment and key shortcomings, carry out industrial software engineering test verification, and further activate data value. Facing the typical scenes of digital China such as intelligent agriculture, intelligent medical care, intelligent manufacturing, intelligent transportation, intelligent energy and intelligent construction, we will promote the transformation and upgrading of a number of in-service equipment, upgrade a number of new equipment and develop a number of cutting-edge equipment. We will build an application and maturation base for intelligent equipment, accelerate the construction of high-level test and verification platforms and inspection and testing platforms, and promote the industrialization of intelligent equipment engineering. Organize the demonstration and application of intelligent equipment, and strongly support the digital transformation and intelligent upgrading of key industries. Accelerate the transformation of service-oriented manufacturing in machinery industry, strengthen demonstration and promotion, expand new space for service business and cultivate new kinetic energy.

3. Strengthen quality brand building. Carry out actions to improve the reliability of mechanical products. We will implement the "foundation-building" project for the reliability of basic products, focusing on improving the reliability, consistency and stability of special parts such as lead screws, guide rails and spindles for industrial mother machines, precision seed metering devices for agricultural machinery, digital hydraulic parts for construction machinery, precision reducers for industrial robots, and general basic parts such as high-end bearings and precision gears. Implement the "multiplication" project of the reliability of the whole machine equipment and system, and strive to improve the reliability level of high-end products such as five-axis linkage machining center, large-scale high-end intelligent agricultural machinery, industrial robots and industrial control devices. Carry out comparative evaluation activities on the quality and performance of machinery and equipment, and formulate international benchmarking lists for industrial mother machines, agricultural machinery and equipment, medical equipment, etc., so as to promote the improvement of key indicators of the reliability of the whole equipment. Carry out national quality benchmarking activities in the machinery industry, support professional organizations to organize experience exchange and training activities to improve the quality control ability of key manufacturing processes, and summarize and form a number of excellent cases for pilot promotion. Encourage the development of high-end quality certification of mechanical products, organize special activities for the upward development of China brands, strengthen the promotion and cultivation of brands in key industries such as industrial machinery, medical equipment, robots, agricultural machinery and equipment, and enhance the brand competitiveness of China.

4. Improve the gradient cultivation system of high-quality enterprises. Select a group of "chain owners" enterprises in the core advantage position of the industrial chain, make good use of special funds, national production integration as platforms, funds and other existing policy channel resources, and "one enterprise, one case" to support enterprises to become stronger, better and bigger. Support industry organizations to cultivate top 100 enterprises in machinery industry and top 100 enterprises in spare parts. In strategic and basic fields such as industrial machinery, robots, medical equipment, agricultural machinery and equipment, instruments and meters, rail transit, and basic parts, we will strengthen the cultivation of "little giant" enterprises, individual champion enterprises, and pilot enterprises, support the professional and differentiated development of enterprises, and create "unique skills." Establish a gradient cultivation platform for high-quality small and medium-sized enterprises, strengthen the dynamic management of enterprise cultivation lists, and strive to improve the quality and efficiency of cultivation. We will implement a number of measures to help small and medium-sized enterprises stabilize their growth and adjust their structural strength, and implement the "one chain, one policy, one batch" financing promotion action for small and medium-sized enterprises. Deepen the service action of "benefiting enterprises together" and carry out the activity of "SME service month". We will implement the "joint action" of financing and innovation for large, medium and small enterprises, and hold the "one hundred enterprises" financing and docking activities for large, medium and small enterprises. Support "chain owners" enterprises to integrate industrial chain resources, promote the construction of a number of industrial technology innovation alliances or innovation consortia of large, medium and small enterprises, carry out collaborative research by upstream and downstream enterprises, form stable supporting and collaborative innovation, and strengthen the supporting resilience of the industrial chain.

5. Promote the coordinated development of key regions. Promote the eastern, central, western and northeastern regions to make full use of the endowment of resource elements and achieve coordinated and differentiated development. While maintaining a stable growth rate, the major machinery provinces in the eastern region should pay attention to the quality of growth, play a leading role in innovation, and make great efforts to break through a number of key parts and complete sets of equipment. Northeast China should speed up the high-end, intelligent and green transformation of traditional advantageous industries, improve industrial operation efficiency, improve market and service capabilities, and promote steady growth, transformation and upgrading of industries. The central and western regions should enhance the regional supporting capacity, undertake the transfer of strategic and basic industries in an orderly manner, speed up the extension and layout of industrial chains, and build a number of internationally competitive machinery and equipment manufacturing bases. Implement the guiding opinions for promoting the orderly transfer of manufacturing industry and the guiding catalogue for the transfer and development of manufacturing industry, carry out "1+N" docking activities for the transfer and development of manufacturing industry, strengthen demonstration and promotion, carry out the selection of typical cooperation modes for industrial transfer, create a number of pilot parks for the transfer of equipment industry, and promote the orderly transfer of eastern coastal industries to the central, western and northeastern regions. Encourage local governments to set up industrial transfer funds on the premise of controllable risks and adhering to marketization. We will promote the development of industrial clusters, cultivate and build a number of characteristic industrial clusters of small and medium-sized machinery and equipment manufacturing enterprises, demonstration bases of new industrialized industries, and advanced manufacturing clusters in the fields of industrial machinery, promote the innovative development of 10 billion-level advanced manufacturing clusters such as rail transit, construction machinery and intelligent equipment, and build industrial clusters with international competitiveness.

(D) adhere to the precise policy of separating industries, and stimulate the steady growth vitality of key industries.

Strengthen precise policies, take the promotion of high-quality development of key sub-sectors as the main line, and make overall plans to promote short-boarding, forging long boards, strengthening foundations, and educating emerging industries, so as to stimulate endogenous and sustained growth momentum in key sub-sectors such as industrial machinery.

1. Make up the chain and upgrade the chain to promote the quality improvement and efficiency improvement of basic equipment.

Industrial mother machine. Strengthen the top-level design, adhere to the problem-oriented, scene traction, pilot verification, group connection, carry out key core technology research, and improve the innovation ability, supply ability and support and guarantee ability of industrial mother machine industry. Promote the digital development of industrial mother machines and support the development of standards and the transformation of results. We will improve the docking mechanism between industrial mother machine enterprises and user enterprises, focus on the needs of key users such as new energy vehicles, aerospace, construction machinery and basic parts, carry out docking activities, encourage key users to boldly try innovative products, and promote the batch application of high-end industrial mother machines. Guide and encourage industrial machine tool enterprises to actively expand overseas markets, optimize the structure of export varieties, and continuously enhance the international competitiveness of high-end industrial machine tool products.

Instruments and meters. Increase support for innovation and tackling key problems in instrument industry. Support superior enterprises to better integrate industry resources, enhance industrial concentration, and cultivate leading enterprises with independent intellectual property rights and international competitiveness. Organize the comparative test and analysis of domestic and imported products, and study and formulate the catalogue of innovative products of high-end instruments and parts. Study and promote the construction of industrial clusters, and support local governments to build industrial clusters in combination with local basic conditions and wishes. Support leading enterprises and research institutes to jointly build a common technology platform to improve the efficiency of research and development of high-end instruments.

Agricultural machinery and equipment. Organize the short-board action of agricultural machinery and equipment, focus on large-scale high-powered high-end intelligent agricultural machinery and small-scale agricultural machinery suitable for hilly areas, accelerate the research and development of short-board machinery and equipment and technological innovation in weak links, optimize the product structure of agricultural machinery and equipment, and fully promote the upgrading of agricultural machinery and equipment. Focusing on the demand of soybean oil crops and agricultural machinery and equipment in hilly and mountainous areas, enterprises, research institutes, extension institutions and application subjects are encouraged to form a consortium to carry out collaborative research. Adopt the mode of "revealing the list and taking the lead" to carry out research and development and popularization and application of urgently needed agricultural machinery and equipment. Support the integrated application of Beidou intelligent monitoring terminal and auxiliary driving system, foster the formation of chain and systematic intelligent operation and command and dispatch capabilities, promote the collaborative innovation of intelligent agricultural machinery, intelligent farms and cloud farms, continue to promote the pilot of unmanned agricultural operations, and promote the development of smart agriculture.

Basic components and basic manufacturing technology. We will carry out actions such as improving innovation capability, engineering application verification, strengthening the chain of industrial chain, cultivating high-quality enterprises and industrial clusters, and promoting advanced manufacturing models to promote breakthroughs in core basic parts, system control technologies and basic manufacturing processes in key areas. Promote the quality improvement project of basic parts to develop in depth, expand the coverage of varieties and specifications, improve the consistency, safety and reliability of basic parts supplied in large quantities, and use the quality early warning mechanism to promote the optimization of industrial structure and market ecology. Strengthen the coordinated development of basic components and complete machines, focus on key areas, give play to the traction role of large professional enterprises and research institutes, promote the coordination of technical standards of basic components and complete machines, and jointly build a common technical cooperation and development platform. Implement the guiding opinions to promote the high-quality development of casting and forging industry, promote the upgrading of processing technology to high efficiency and refinement, and promote the standardized, innovative, green and intelligent development of casting and forging enterprises.

2. Strengthen the chain and consolidate the development momentum of advantageous industries.

Construction machinery. Efforts will be made to improve the industrial basic capabilities, break through key core technologies and components such as system control and hydraulics, and fill the shortcomings of industrial development. Guide enterprises to strengthen the research and scale application of key core components such as batteries, motors and electronic controls for new energy construction machinery. Study and carry out pilot and promotion support policies for the application of new energy construction machinery, explore the exit mechanism of old construction machinery, and support qualified areas to take the lead in implementing the filing management and exit mechanism of construction machinery. Focus on typical application scenarios such as mines and ports, and the needs of major engineering construction such as sichuan-tibet railway, and carry out demonstration applications of electric products such as electric excavators and electric loaders. Support enterprises to strengthen the cultivation and international promotion of construction machinery brands, improve the global brand service system, and stabilize the export growth resilience.

Rail transit equipment. Widely apply new materials, new technologies and new processes to create independent, intelligent and green rail transit equipment products with international competitiveness. Strengthen the key components of vehicles, traction, braking, signal, power supply and other systems. Support qualified rail transit vehicle and core parts enterprises to build smart factories. Carry out basic research on rail transit equipment manufacturing and development of green intelligent equipment, and expand the "manufacturing+service" model. Support rail transit equipment enterprises to "go global", carry out global operation, and build an all-round international operation capability of "product+service+technology+investment".

3. Build and extend the chain, and continue to cultivate and expand emerging industries.

Robots. Promote the formation of a number of collaborative innovation consortia between production and use, establish a collaborative research mechanism between production and demand with enterprises as the main body, and accelerate the iterative upgrade of the whole machine and parts with demand as the traction. In-depth implementation of the "robot+"application action, improve the supply capacity of robot products and system solutions in automotive, electronics, aerospace, rail transit, new energy, medical care, agriculture and other application fields. Promote the establishment of an inter-departmental collaborative promotion mechanism, and build a public service platform for supply and demand docking and application promotion of the "robot+"industrial chain. In the mature application field, select a number of benchmark enterprises and typical scenarios with outstanding application results and strong influence. In the field of emerging applications and potential demand, a number of innovative technologies and solutions for robot applications are collected through "revealing the list".

Medical equipment. Promote the establishment of a collaborative working mechanism between industry and information technology, health and drug supervision, and strive to open up the chain of high-end medical equipment development, registration and approval and clinical innovation. Build a collaborative innovation platform for Industry-University-Research medical institutions, strengthen key core technology research, speed up the completion of the shortcomings of the high-end medical equipment industry chain, and improve the resilience and safety level of the supply chain of the industry chain. We will promote the integrated development of medical equipment with 5G, artificial intelligence, big data and Internet of Things, foster new models and formats such as telemedicine, smart medical care and mobile medical care, and promote high-quality medical resources to benefit the broad masses of the people. Create a number of high-end medical equipment application demonstration bases, promote clinical verification and application promotion of medical equipment, and select a number of excellent application scenarios for telemedicine and smart medical care.

Fourth, safeguard measures

(1) Increase policy support. Using existing capital channels to support machinery manufacturing enterprises to tackle key core technologies and carry out intelligent green transformation. Give full play to the role of national industrial integration as a platform, guide financial institutions to increase credit support, and comprehensively use various financial instruments according to the characteristics of the machinery industry to improve the quality and efficiency of financial services.

(2) Strengthen standard supply. We will strengthen the revision of standards for general parts, core special parts for main equipment, general manufacturing processes, instruments and special equipment, and improve the standard systems for industrial mother machines, medical equipment, agricultural machinery and equipment, and robots. Aim at industrial upgrading, speed up the construction of data security standard system, and promote the development of product life cycle reliability standards such as reliability design, analysis, test, evaluation, operation and maintenance and application of key core products in key industries. Accelerate the development of key technologies and industry application standards for intelligent manufacturing, organize the implementation of standard pilot actions, and carry out standard application pilot and standard implementation activities. Encourage industry associations to jointly develop advanced group standards with leading enterprises, actively participate in international standardization work, and promote the internationalization of machinery industry standards.

(3) Strengthen monitoring and dispatching. Use the information platform such as "Digital Industry Information" to strengthen the operation monitoring and scheduling analysis, and timely discover the problems of signs, potentials and tendencies in operation. Organize and hold economic operation analysis meetings of key industries and key regions, strengthen analysis and judgment, and timely grasp the development of regions, industries and enterprises. Implement the spirit of the CPC Central Committee’s investigation and research on Daxing, organize special research on steady growth, go deep into the grassroots and industry front line, understand the pain points and difficulties that restrict the development of enterprises in the industry, and coordinate and solve the problem of "urgent difficulties and worries" of enterprises. Strengthen information sharing and experience summary, excavate typical cases of steady growth of local and industry, and refine and popularize the experience and practices that can be used for reference.

(4) Strengthen organization and implementation. All departments should deeply understand the significance of promoting the steady growth of the machinery industry to stabilize the basic economic disk, compact their responsibilities, strengthen coordination and cooperation, form joint efforts, implement various measures in detail, pay close attention to implementation, and make overall plans to promote the steady growth of the machinery industry. All localities should base themselves on reality, introduce targeted policies for the steady growth of the machinery industry in the region, stabilize the development of key industries and key enterprises, and strive to achieve the expected goals. Promote the establishment of linkage and consultation and exchange mechanism between central and local governments, adhere to the goal and problem orientation, and coordinate and solve major problems encountered in the development of machinery industry. Industry associations, industry alliances and other industry organizations should play a service and supporting role, increase policy interpretation and positive publicity, strengthen investigation and research, judge the impact of domestic and international situations on the industry in this field, especially the impact of small and medium-sized enterprises, timely reflect and help enterprises solve problems, actively build an industry exchange and exhibition platform, and strengthen the docking of supply and demand. The competent departments of industry and information technology in various regions and relevant national trade associations regularly submit the progress in the implementation of steady growth in their respective regions and industries every year.

Interpretation of Work Plan for Steady Growth of Machinery Industry (2023-2024)

Recently, the Ministry of Industry and Information Technology, together with the Ministry of Finance, the Ministry of Agriculture and Rural Affairs, the Ministry of Commerce, the General Administration of Customs, the General Administration of Financial Supervision and National Medical Products Administration, issued the Work Plan for Steady Growth of the Machinery Industry (2023-2024) (Ministry of Industry and Information Technology Liantongzhuang [2023] No.144, hereinafter referred to as the Work Plan). In order to understand the Work Plan and implement it well, the relevant contents are now interpreted as follows:

First, the introduction background

The Central Economic Work Conference proposed that in 2023, we should "focus on stabilizing growth, employment and prices". Politburo meeting of the Chinese Communist Party stressed that it is necessary to adhere to the general tone of striving for progress while maintaining stability, make efforts to expand domestic demand, boost confidence, guard against risks, and constantly promote the sustained improvement of economic operation.

The machinery industry is a basic and strategic industry that provides technical equipment for the development of national economy, national defense, military industry and people’s livelihood. It is an important cornerstone to support the country’s manufacturing capacity and comprehensive national strength, and a "ballast stone" to stabilize the industrial economy. It undertakes the important task of promoting the technical progress and technological level of the industry and meeting the needs of people’s better life, involving manufacturing, construction, agriculture, transportation, scientific research, people’s life and other aspects. At present, the external environment is complex and severe, the domestic demand is insufficient, some enterprises have difficulties in operation, and there are many hidden dangers in key areas. The development of machinery industry is facing a new situation, and the pressure of steady growth of the industry is great.

The Ministry of Industry and Information Technology has conscientiously implemented the decision-making arrangements of the CPC Central Committee and the State Council, worked with seven departments including the Ministry of Finance to study and formulate a work plan for the steady growth of the machinery industry, and made efforts to stabilize key sub-sectors, promote the steady growth of the machinery industry, and support the industrial economic growth to achieve the expected goals. The Work Plan mainly focuses on 11 sub-sectors such as machine tools, agricultural machinery, construction machinery, instruments and meters, robots, rail transit equipment, medical equipment, mechanical basic parts, cultural office equipment, food packaging machinery and other civil machinery, involving 7 major categories, 36 middle categories and 108 sub-categories of the national economy.

Second, the guiding ideology and main objectives

Guided by Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, the Work Plan fully implements the decision-making arrangements of the CPC Central Committee and the State Council, adheres to the general tone of striving for progress while maintaining stability, better coordinates the structural reform of the supply side and expands domestic demand, and strives to gather the joint efforts of industries, enterprises and localities to create effective demand through high-quality supply, strengthen systematic thinking and problem-oriented, take multiple measures simultaneously, and make separate policies to optimize supply, boost demand and stabilize expectations. Efforts will be made to stabilize key sub-sectors and keep the operation of machinery industry within a reasonable range, so as to lay a solid foundation for accelerating new industrialization, building a manufacturing power and building a socialist modern country in an all-round way.

The "Work Plan" proposes that from 2023 to 2024, the operation of the machinery industry will maintain a stable and good trend, the resilience and safety level of the supply chain of key industrial chains will continue to improve, and the quality and efficiency of industrial development will continue to increase. The specific objectives are: strive for an average annual growth rate of more than 3%, reaching 8.1 trillion yuan by 2024; The scale of key industries is rising steadily, new growth points are constantly emerging, the competitiveness of enterprises is further enhanced, and the supply capacity is significantly improved; The construction of industrial clusters has been continuously promoted, and a number of competitive small and medium-sized enterprise characteristic clusters and about 10 industrial clusters with international competitiveness have been cultivated.

III. Main Work Measures and Safeguard Measures

The "Work Plan" proposes to adhere to the "two main lines", do a good job in "four overall plans" and strengthen the "four motivations", and put forward 16 key tasks in four aspects and four safeguard measures from the supply and demand sides.

(1) About the "two main lines". On the demand side, focusing on improving effective demand, we will focus on expanding investment, promoting consumption, stabilizing exports, promoting intelligent transformation and upgrading of manufacturing industry, and fully stimulating the demand potential of machinery and equipment. On the supply side, with the overall improvement of supply capacity as the main line, we will strengthen separate policies, make every effort to improve the resilience and safety level of the industrial chain supply chain, lead and create effective demand with high-quality supply, and promote a virtuous circle of supply and demand at a higher level.

(2) About "Four Overall Plans" and "Four Motives". First, make overall plans to expand investment, promote consumption, stabilize exports, enhance effective demand, and make the machinery industry grow steadily. The second is to make overall plans for tackling key problems, model innovation and popularization and application of intelligent manufacturing, accelerate the intelligent transformation and upgrading of manufacturing industry, fully release the investment demand for new or updated equipment, and do a solid support for the steady growth of the hard machinery industry. The third is to make overall plans for the construction of industrial ecological system, improve the resilience of industrial chain supply chain, innovate the supply of high-quality equipment, and be the driving force for the steady growth of fine machinery industry. The fourth is to make overall plans to make up for shortcomings, forge long boards, strengthen foundations, cultivate emerging industries and new growth points, and make precise policies to stimulate the stable growth vitality of eight key sub-sectors such as industrial machinery.

(3) About 16 important tasks in four aspects

In terms of continuously expanding effective demand, aiming at the fact that the machinery industry provides technical equipment for other industries, and more than 70% of the demand comes from infrastructure construction and investment in new or upgraded equipment in other industries, which is the main battlefield for stabilizing exports, four key tasks are put forward, namely, digging deep into the domestic market potential, focusing on expanding effective investment, actively exploring the international market, and building a high-level supply-demand docking platform.

In promoting the intelligent transformation of manufacturing industry, four key tasks are put forward, such as accelerating the promotion of new intelligent manufacturing models, promoting the research of intelligent manufacturing system solutions, promoting the digital transformation of small and medium-sized enterprises, and exploring the construction of intelligent manufacturing pioneer areas.

In terms of improving high-quality supply capacity, five key tasks are put forward, such as stabilizing and smoothing the supply chain of key industrial chains, accelerating the digital development of equipment, strengthening the construction of quality brands, improving the gradient cultivation system of high-quality enterprises, and promoting the coordinated development of key regions.

In terms of precise policy of separation, three key tasks are put forward, namely, supplementing and upgrading the chain to promote the quality and efficiency of basic equipment, strengthening the chain to consolidate the development momentum of advantageous industries, and building and extending the chain to continuously cultivate and expand emerging industries, so as to promote the steady growth of eight key sub-sectors such as industrial machinery, instruments and meters, agricultural machinery and equipment, basic parts and basic manufacturing processes, construction machinery, rail transit equipment, medical equipment and robots.

(4) About four aspects of safeguard measures. First, increase policy support. Support equipment manufacturing enterprises to carry out key core technology research and intelligent green transformation. Give full play to the role of national industrial integration as a platform, guide financial institutions to increase credit support, and comprehensively use various financial instruments to improve the quality and efficiency of financial services. The second is to strengthen the standard supply. Strengthen the revision of standards, improve the standard system of industrial machine tools and medical equipment, and accelerate the development of key technologies and industrial application standards for intelligent manufacturing. Promote the internationalization of machinery industry standards. The third is to strengthen monitoring and dispatching. Use the information platform such as "digital information" to strengthen the monitoring of the economic operation of the equipment industry, carry out in-depth investigation and study, and coordinate and solve the difficulties and problems faced by the development of industrial enterprises in a timely manner. The fourth is to strengthen organization and implementation. Strengthen departmental coordination, promote the establishment of central-local linkage and consultation and exchange mechanisms, and coordinate and solve major problems. Encourage local governments to base themselves on reality and introduce targeted policies for steady growth in the region. Give play to the service and supporting role of industry organizations, build an industry exchange and display platform, and strengthen the docking of supply and demand.